Yesterday The Economist online published an article on travel restrictions that currently exist for people with HIV.

Yesterday The Economist online published an article on travel restrictions that currently exist for people with HIV. Do these polices make sense and is there a human rights issue? Whats your take.

Inviting all of those interested in economics to discuss everything economics... from financial markets to present day global issues to the economist's job market.

At this point the perceived chances for a double dip recession seems lower than a few months ago. The potential Greek default added a huge amount of fear to financial markets making investors extremely bearish.

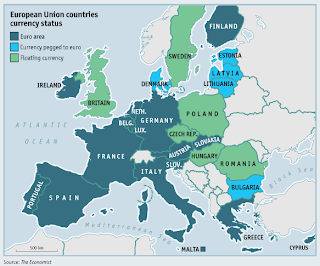

At this point the perceived chances for a double dip recession seems lower than a few months ago. The potential Greek default added a huge amount of fear to financial markets making investors extremely bearish.  What will happen to the euro zone, will it survive in its current form?

What will happen to the euro zone, will it survive in its current form?